Home /

Expert Answers /

Anatomy and Physiology /

e10-15-algo-preparing-a-bond-amortization-schedule-for-a-bond-issued-at-a-premium-and-determinin-pa352

(Solved): E10-15 (Algo) Preparing a Bond Amortization Schedule for a Bond Issued at a Premium and Determinin ...

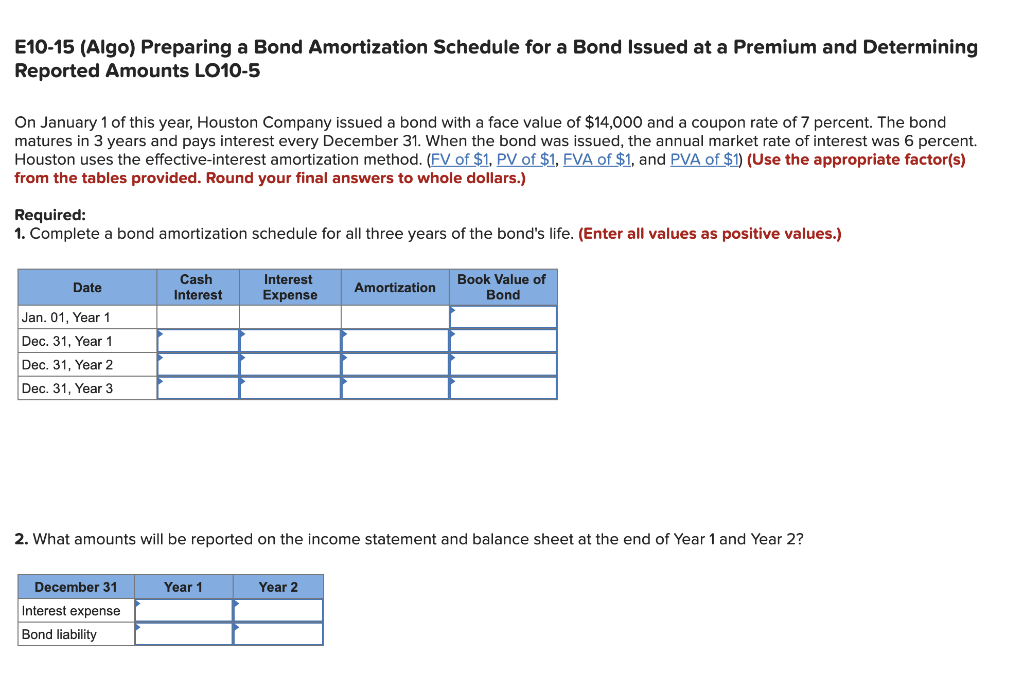

E10-15 (Algo) Preparing a Bond Amortization Schedule for a Bond Issued at a Premium and Determining Reported Amounts LO10-5 On January 1 of this year, Houston Company issued a bond with a face value of $14,000 and a coupon rate of 7 percent. The bond matures in 3 years and pays interest every December 31. When the bond was issued, the annual market rate of interest was 6 percent. Houston uses the effective-interest amortization method. (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use the appropriate factor(s) from the tables provided. Round your final answers to whole dollars.) Required: 1. Complete a bond amortization schedule for all three years of the bond's life. (Enter all values as positive values.) Date Cash Interest Interest Expense Amortization Book Value of Bond Jan. 01, Year 1 Dec. 31, Year 1 Dec. 31, Year 2 Dec. 31, Year 3 2. What amounts will be reported on the income statement and balance sheet at the end of Year 1 and Year 2? Year 1 Year 2 December 31 Interest expense Bond liability